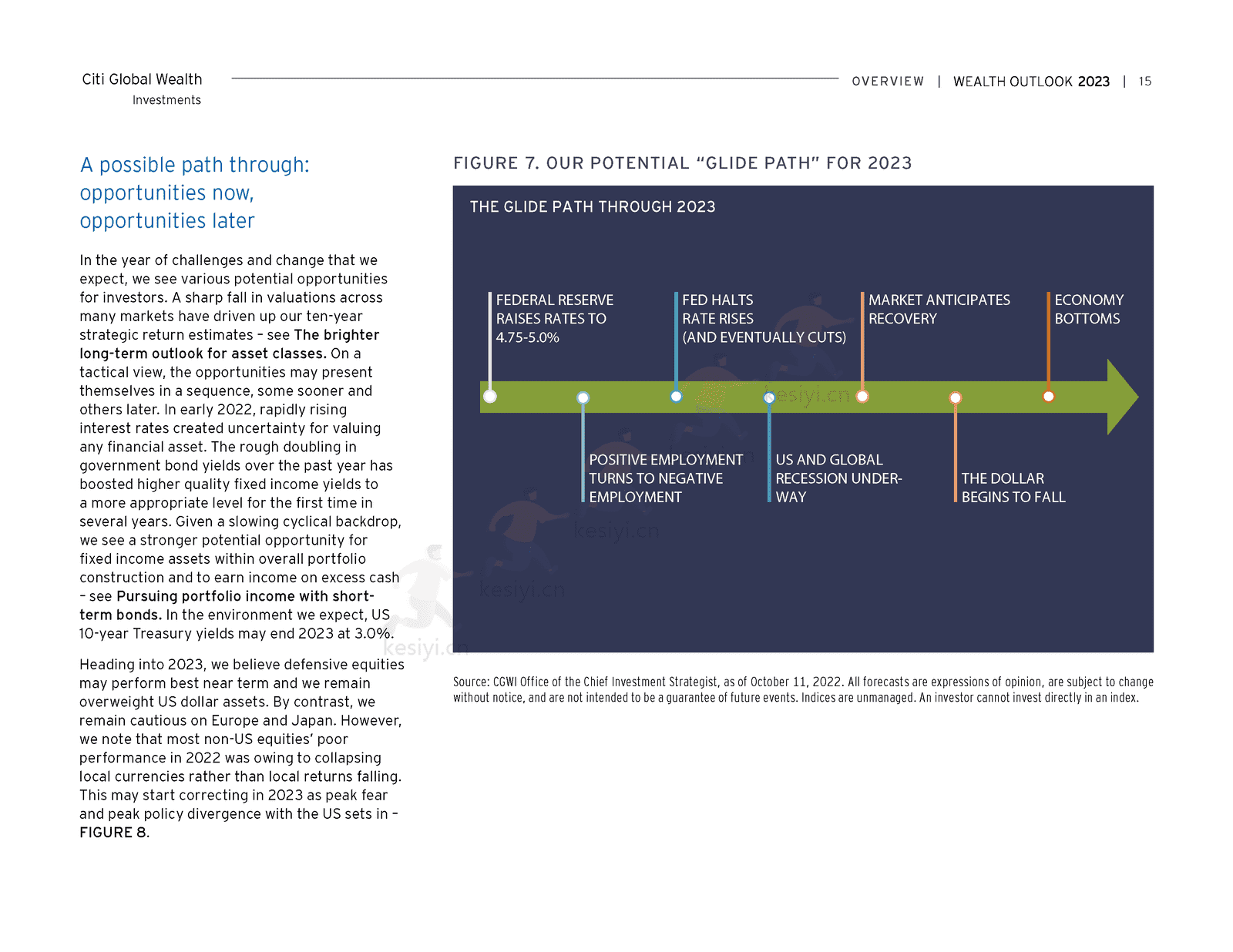

While 2023 will still have its share of challenges, we also see it as a year of change and opportunity. In the US, we expect a mild recession, with regions such as the eurozone being more heavily impacted. As inflation subsides, we see the US Federal Reserve pivoting from interest rate hikes to cuts and markets shifting focus to 2024 recovery, unlocking more potential opportunities for investors.

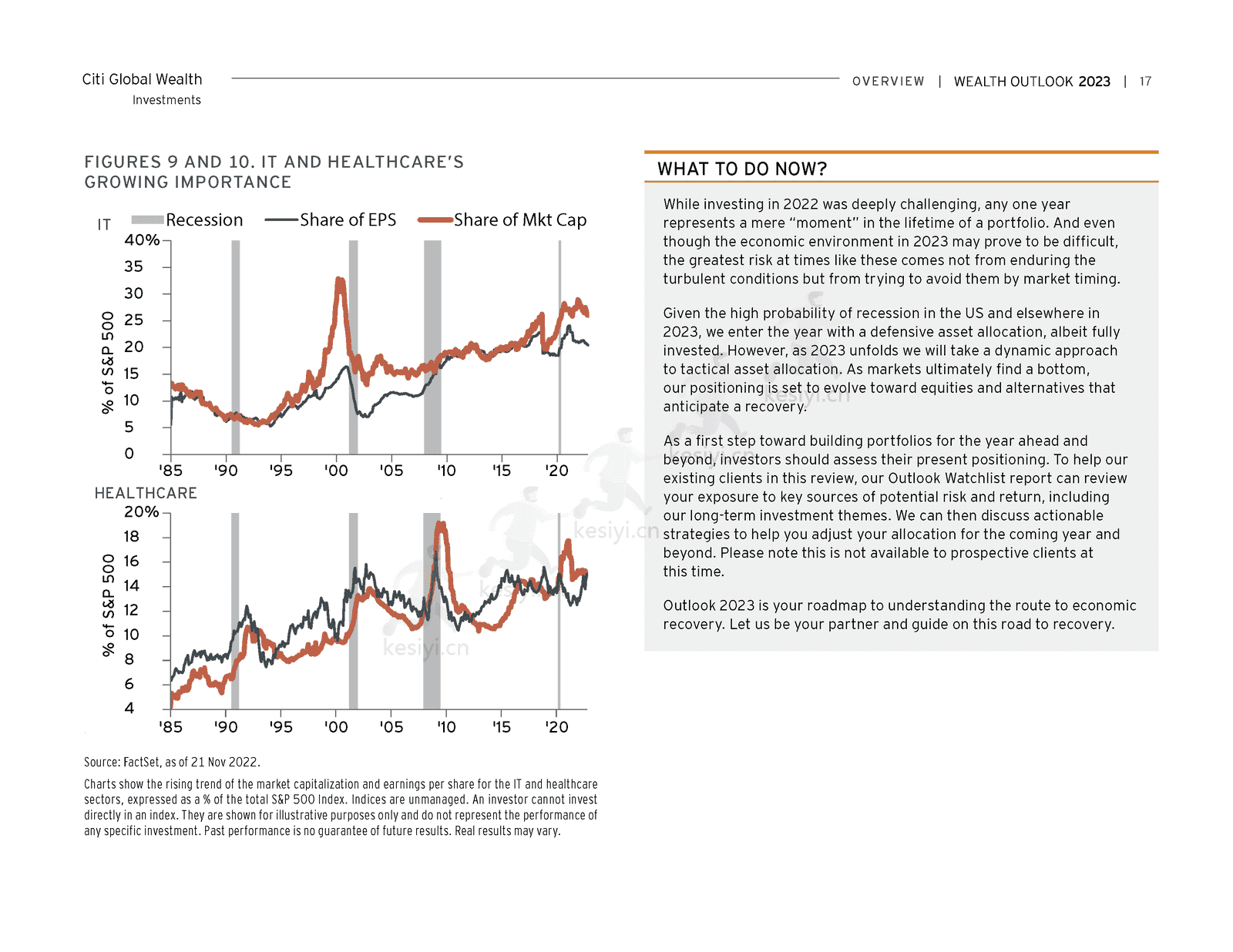

As the markets continue to swing, timely guidance has become even more valuable. Our insights help us engage in deeper client conversations and create strategies that achieve your investment objectives. The value of keeping portfolios fully invested remains increasingly important – market timing can come at a great cost, as turning points often arrive with little warning.

For your convenience, we have also created helpful summaries, including Findings & Opportunities and a new version of this publication in just two sides.

We look forward to continued partnership and success in the new year.

1 / 112

1 / 112

2 / 112

2 / 112

3 / 112

3 / 112

4 / 112

4 / 112

5 / 112

5 / 112

6 / 112

6 / 112

7 / 112

7 / 112

8 / 112

8 / 112

9 / 112

9 / 112

10 / 112

10 / 112

11 / 112

11 / 112

12 / 112

12 / 112

13 / 112

13 / 112

14 / 112

14 / 112

15 / 112

15 / 112

16 / 112

16 / 112

17 / 112

17 / 112

18 / 112

18 / 112

19 / 112

19 / 112

20 / 112

20 / 112

21 / 112

21 / 112

22 / 112

22 / 112

23 / 112

23 / 112

24 / 112

24 / 112

25 / 112

25 / 112

26 / 112

26 / 112

27 / 112

27 / 112

28 / 112

28 / 112

29 / 112

29 / 112

30 / 112

30 / 112

本文档共112页,请下载完整版阅读。

免责声明:本平台只做内容的收集及分享,内容版权归原撰写发布机构(或个人)所有,由小编通过公开合法渠道获得,如涉及侵权,请联系我们删除;如对报告内容存疑,请与撰写、发布机构联系。